Death Benefits from Super – whose will?

What happens to your Superannuation in the event of your death? It may not be as simple as you think.

Follow the link below to find out more:

What happens to your Superannuation in the event of your death? It may not be as simple as you think.

Follow the link below to find out more:

Since 2007, Self-Managed Super Funds have been able to utilise leverage to invest. But the rules surrounding this amendment are exceptionally complex. Our friends over at Cooper Grace Ward have shed a little light on the subject, see the link below.

There are advantages and disadvantages to holding your income protection insurance within superannuation. Money Management Magazine outline how to navigate these complex waters in the article below:

When should Income Protection cover be held inside Superannuation?

Good estate planning ensures that your assets go to the people that you want to benefit when you die. A large part of good estate planning is having a valid and up-to-date Will.

Your Will

Once your Will has been signed, you should revisit it regularly to make sure that it still gives effect to your wishes. There are also some circumstances in which your Will might be revoked or invalidated and you should prepare a new one.

Events that might revoke or invalidate your Will

If your Will is revoked or invalidated and you do not prepare a new one, your previous Will or the rules of intestacy will be applied to your estate when you die.

The following events may have the effect of re-writing or revoking all or part of your Will:

1. If you get married or enter into a registered relationship after signing your Will.

2. If you get divorced from the spouse that you were married to at the time of signing your Will.

These can also revoke your Enduring Power of Attorney.

In some circumstances, you can make a valid Will and Enduring Power of Attorney in contemplation of marriage or divorce so that they do not need to be re-written when the later event occurs.

Your overall estate plan

A good estate plan will also deal with assets that you cannot pass under your Will, including, superannuation and assets in a family trust or company. Therefore, when considering and updating your Will, it is important to revisit your entire estate plan to ensure that all of the assets that you control are properly dealt, particularly if your structure has changed since your last review.

Events that might affect your overall Estate Plan

Generally, you should revisit your estate plan at least every 3 to 5 years. Some examples of when you should revisit your estate plan sooner include:

1. your financial circumstances changing;

2. your family circumstances changing, for example,

3. if you marry, start a new relationship, divorce, separate, or have children or grandchildren;

4. a beneficiary under your current Will dying;

5. an executor or trustee appointed under your current Will dying or becoming unsuitable to act due to age or ill-health;

6. you sell or give away assets that are specifically mentioned in your Will;

7. you buy or inherit significant assets;

8. you begin to hold assets that your Will cannot deal with, such as in superannuation or a trust; and

9. the entities or structures you hold assets in change.

It is important that all of the necessary legal requirements to give effect to any changes or updates to your Will (and other documents, such as trust deeds) are completed correctly, otherwise your wishes may not be carried out. In some circumstances and if done incorrectly, small changes made to a Will can revoke or invalidate the entire document. Therefore, it is important that you seek appropriate advice and do not try to amend or alter your estate planning documents yourself.

To update your estate plan or get advice about whether it is necessary for you to do so, contact a member of our estate planning team.

For those of you out there who are undertaking additional studies while working, this article is a must read. You may be entitled to claim a deduction for self-education expenses if you are engaged in studies while working. The study must be appropriately related to your current work and be deemed as an ‘eligible course’ by the ATO.

Eligible courses are those undertaken to obtain a formal qualification from a school, college, university or other place of education. The course must have a sufficient connection to your current employment (general relation is not enough) either by maintaining or improving the specific skills or knowledge you require in your current employment or will result in, or likely to result in, an increase in your income from your current employer. You cannot claim a deduction for self-education expenses for a course that relates only in a general way to your current employment/profession or will enable you to get new employment.

The range of self-education expenses you can claim is quite expansive and includes accommodation and meals while away from home overnight, computer consumables, course fees, decline in value for depreciating assets costing more than $300, equipment purchases of less than $300, repairs, parking, student union fees and textbooks.

While most of your study is done at home, further deductions are able to be claimed in relation to home office running costs, internet usage, phone calls, postage, stationery and travel. Where an item or service is used partly for your self-education and partly for other purposes, the expense is apportioned between the uses on a reasonable basis and only the proportion that equates to the self-education use is claimed as a deduction.

As you know, studying can be expensive, so anyone who accumulates their education debt via a Higher Education Loan Program (HELP), HECS or similar, cannot claim a deduction for any payments made to reduce the debt. Only course fees paid upfront are deductible.

Certain eligible expenditure incurred from self-education is reduced by $250 as required by the ATO. Private costs including non-deductible travel, childcare costs and capital purchase costs are not available to deduct but are used for the purposes of the $250 reduction.

To seek any further clarifications, please contact us any time here at CNS Partners.

The past few years have been tumultuous for the Financial Services Industry, dominated by Government intervention and the introduction of new legislation. Some aspects of this legislation has been highly controversial and faces constant debate, scrutiny and lobbying for change. Why the fuss? What does it all mean? How does any of this affect the man on the street?

Changes have been made to try and protect consumers. We all remember Westpoint, Storm Financial, Wickham Securities — the list could go on from there. All were examples of greed and self-interest, coupled with lack of supervision, leading to many small investors losing their life savings. Also, financial services have traditionally been sales based and commission driven, creating the potential for advice to be skewed towards the remuneration of the adviser, rather than the best interest of the client. Legislative change has endeavoured to correct some of this bias and return the focus to benefitting the client.

Unfortunately, this protection has come at a cost. Advisers must now satisfy complex, stringent compliance criteria and produce copious quantities of paperwork. What was designed to protect and safeguard, has had the unintended side effect of adding cost. Any advice given must be substantiated, because it is important to be responsible with hard earned savings. However, the cost now precludes some people from seeking simple advice, which is a setback for the entire country. Rather than fight against the system though, we must accept that protection comes at a price and be vigilant about finding out what we are actually paying for.

Real Estate agents commonly quote the Latin phrase ‘caveat emptor’ which loosely translates to ‘Buyer Beware’. This is equally apt for financial advice, not as a justification for bad service, but as a warning to consumers to ask questions and make sure they understand what they are getting. Ask what is involved and how much it will cost, then make an informed decision. Advisers who are proud of their service will be comfortable discussing this with you.

While tax-effective structures may be in place to reduce tax, end of year tax planning strategies look at the position of each business or individual and seek to take advantage of legitimate tax minimisation opportunities and techniques.

Tax planning is best done between April and June to ensure that advisors have enough information about the performance of businesses and investments throughout the year and also enough time to ensure strategies are put in place.

It is important to note that the information on the following strategies is general in nature and we therefore strongly recommend you contact our office before proceeding with any year end planning opportunities discussed below.

– Individuals under 60 years of age – $25,000

– Individuals over 60 years of age – $35,000

It is of vital importance that you contact our office prior to purchasing or selling any significant assets and that means before executing any relevant documentation

As indicated above it is important that you contact CNS Partners before implementing any strategies.

One of the many misconceptions surrounding Self-Managed Super Funds is that you need a large super balance before they are worthwhile. While this may have been the case a few years ago, the cost of setting up and maintaining your very own SMSF is probably cheaper than you think.

The ATO recommends that you should have at least $200,000 in superannuation before an SMSF is competitive with larger retail and industry funds. However, we think that it’s possible to manage an efficient fund with less than this.

Consider a husband and wife with $200,000 each in a retail or industry fund. Depending on their fund and investment mix, they could be paying fees of almost $4,800 between them. If they were to set up an SMSF, and invest in simple investments such as Australian Shares, Term Deposits etc., their total annual cost may be as low as $2,500. This includes administration, audit, ATO levies, and investment expenses (brokerage etc.).

Notwithstanding the cost advantage, there are other benefits to having an SMSF. Along with having greater control over investments and risk, CNS can provide SMSF’s with tailored tax advice and retirement strategies. Having superannuation experts review your fund annually (or more often) enables more effective tax, pension, and contribution planning.

This isn’t to say that the SMSF route is right for everyone. Typically, SMSF’s are suited to those who already (or desire to) take a great interest in their superannuation. While some investment experience can be advantageous, it is not absolutely necessary. It can be empowering and dare we say “fun” to take control of your retirement savings.

After over 2 decades, the Australian Accounting Standards Board (AASB) will finally issue an updated Standard for the financial reporting of Superannuation Entities.

Much has changed in the Super industry since AAS 25 was issued in 1993, and the new standard will accommodate the rapidly developing SMSF market.

Read more here: New standard for superannuation entities

If you’re a small business owner, and part of the Baby Boomer generation, Succession Planning should be at the forefront of your mind.

Check out the article below from the Institute of Chartered Accountants:

Have you been tempted by a smooth talking financial planner or a silver tongued real-estate agent into buying property within your superannuation?

Get the facts on LRBA’s beforehand and make an informed decision. Check out the article below.

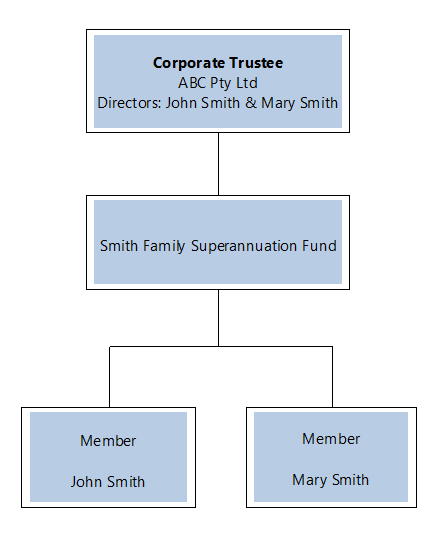

When it comes to setting up a Self-Managed Super Fund (SMSF), one of the first decisions that must be made is whether you will act as trustees for the fund in your own names or through a company. While it may be initially cheaper to simply install individual trustees (the members), there are a number of important arguments for the alternative.

Depending on the firm used to complete your SMSF set up, it can cost an extra $500 – $800 to use a corporate trustee for your fund. This may seem like a lot when the cost of setting up the actual fund is usually less than that. But the consequences for not taking this extra precaution can total far more than this over your lifetime. In effect, a corporate trustee can provide the same control over the fund as individuals can, the only difference being that the parties are directors of the company rather than trustees of the fund directly.

Ease of Management: In the regrettable situation of divorce, having a corporate trustee can be an enormously beneficial. For example, if a husband and wife were to divorce and the SMSF remains with the husband, it can cost thousands to transfer the ownership of investments from ‘John & Mary as Trustee for’ to ‘John as Trustee for’. In the event that John & Mary are using a corporate trustee, a simple change of directorship and transfer of shares can take place. There is no need for costly off market transfers, possible stamp duty consequences, and exceptional hassle. This applies to many situations including the passing of a member and the involvement of child members.

Flexibility of Control: When using a corporate trustee, it is possible to apportion power over the fund to various parties in non-equal amounts. This is particularly useful in blended families or SMSF’s involving owners of a small business.

We believe that in nearly all cases, the benefits of this strategy outweigh the initial set-up cost, and have been advising clients who are setting up new SMSF’s accordingly.