When it comes to setting up a Self-Managed Super Fund (SMSF), one of the first decisions that must be made is whether you will act as trustees for the fund in your own names or through a company. While it may be initially cheaper to simply install individual trustees (the members), there are a number of important arguments for the alternative.

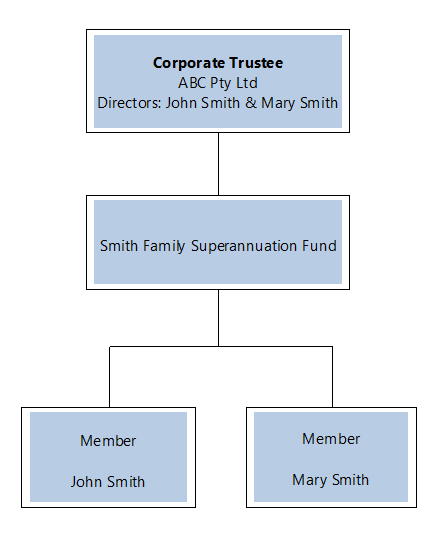

Depending on the firm used to complete your SMSF set up, it can cost an extra $500 – $800 to use a corporate trustee for your fund. This may seem like a lot when the cost of setting up the actual fund is usually less than that. But the consequences for not taking this extra precaution can total far more than this over your lifetime. In effect, a corporate trustee can provide the same control over the fund as individuals can, the only difference being that the parties are directors of the company rather than trustees of the fund directly.

Ease of Management: In the regrettable situation of divorce, having a corporate trustee can be an enormously beneficial. For example, if a husband and wife were to divorce and the SMSF remains with the husband, it can cost thousands to transfer the ownership of investments from ‘John & Mary as Trustee for’ to ‘John as Trustee for’. In the event that John & Mary are using a corporate trustee, a simple change of directorship and transfer of shares can take place. There is no need for costly off market transfers, possible stamp duty consequences, and exceptional hassle. This applies to many situations including the passing of a member and the involvement of child members.

Flexibility of Control: When using a corporate trustee, it is possible to apportion power over the fund to various parties in non-equal amounts. This is particularly useful in blended families or SMSF’s involving owners of a small business.

We believe that in nearly all cases, the benefits of this strategy outweigh the initial set-up cost, and have been advising clients who are setting up new SMSF’s accordingly.