Continuing on from last month’s article regarding motor vehicle deductions, it is now time to elaborate on when you are eligible to claim such a deduction.

So to refresh your mind, there are 4 methods used to determine the amount of motor vehicle deduction available. They are; Cents per kilometre, 12% of original value, One-third of actual expenses or the Logbook method.

You can claim a deduction for work-related car expenses if you use your own car in the course of performing your job as an employee. For example;

• where you carry bulky tools or equipment,

• to attend conferences or meeting,

• to deliver items or collect supplies,

• to travel between two separate places of employment where you have two jobs,

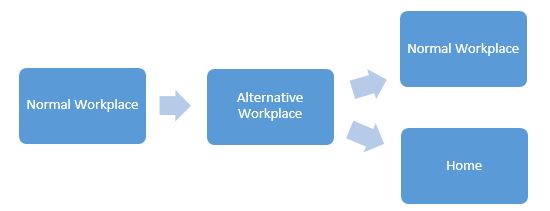

• to travel from your normal workplace to an alternative workplace and back to either your normal workplace or directly home

to travel from your home to an alternative workplace and then to your normal workplace or directly home (for example where you travel to a client’s premises)

Like all tax deductions, you can only claim work-related portions. Therefore, any travel that is deemed private cannot be claimed. For example, an employee’s daily commute from the home to the office is private travel and cannot be claimed. However, people doing itinerant work or who need to carry bulky tools or equipment that is used for work and can’t be left at the workplace can claim for driving between work and home. For any clarifications, please contact CNS Partners.