For those unfamiliar with the term, preference shares (otherwise dubbed Hybrids) are listed investments that have both ‘debt’ and ‘equity’ characteristics. Companies sell/issue hybrids on the Australian Stock Exchange as a way of raising capital without diluting the value of ordinary shareholdings. Whilst every offering is different and have their own individual contracts, they are effectively an interest only loan to the issuing company, where as an investor/lender, you are expected to receive:

– Predetermined distributions (interest payments for the loan), and

– Repayment of the original listing price at maturity (commonly in cash or ordinary shares).

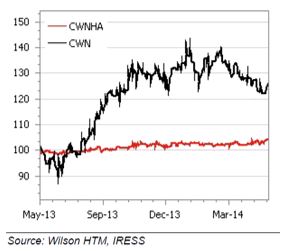

Similar to a loan, the payment (interest) rate is determined based on the likelihood of the company defaulting. Therefore, companies with high credit ratings (e.g. Commonwealth Bank’s AA- rating) may pay a lower distribution but in turn has a very low risk of defaulting. If used correctly, hybrids can provide the investor with equity like income without the volatility. The below chart shows the price movement of Crown Resorts (CWN) compared to their Hybrid Subordinated Debt (CWNHA) over the last 12 months:

Whilst CWNHA did not receive the growth of the issuers stock, it provided a gross income return of approximately 7% and much greater capital stability, holding its value following an initial dip in CWN stock price. This is significant give an RBA cash rate of 2.50-2.75% over this period.

The key risk of hybrid securities is that the issuing company is unable to repay the debt at the end of the agreed term. Because of this, many hybrids suffered losses during the GFC as investors sold their holdings to avoid the risk of default and this drove down the price. High quality hybrid offerings did however continue to pay the predetermined distributions throughout this period and have since recovered in price and are currently trading around their original issue price.

Hybrids can benefit an investor by providing an increased level of income (which may include franking credits) for superannuation, pension or personal portfolios without the inherent volatility direct share investments would expect over time. Depending on the investor’s attitude towards risk, hybrids can be a great alternative to cash and fixed interest investments.

Wilson HTM provides dedicated hybrid research and can assist you in reviewing whether hybrids may be appropriate to your personal situation and investment strategy. If you would like to discuss hybrids or any other investment matters further, please feel free to contact Ben Davis at Wilson HTM.

Ben Davis, Wilson HTM Investment Group: 07 3212 1038

Disclaimer. Whilst Wilson HTM Ltd believes the information contained in this communication is based on reliable information, no warranty is given as to its accuracy and persons relying on this information do so at their own risk. To the extent permitted by law Wilson HTM Ltd disclaims all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage) however caused, which may be suffered or arise directly or indirectly in respect of such information.

The advice contained in this document is general advice. It has been prepared without taking account of any person’s objectives, financial situation or needs and because of that, any person should, before acting on the advice, consider the appropriateness of the advice, having regard to the client’s objectives, financial situation and needs. Those acting upon such information without first consulting one of Wilson HTM Ltd investment advisors do so entirely at their own risk. This report does not constitute an offer or invitation to purchase any securities and should not be relied upon in connection with any contract or commitment whatsoever. If the advice relates to the acquisition, or possible acquisition, of a particular financial product the client should obtain a Product Disclosure Statement relating to the product and consider the Statement before making any decision about whether to acquire the product. This communication is not to be disclosed in whole or part or used by any other party without Wilson HTM Ltd’s prior written consent.